Using a zero-based budget is a great way to reach your financial goals. Learn what a zero-based budget is, how to make one, and the benefits of using it.

Do you want to eliminate financial stress, pay off debt, build your savings, or find money for retirement? If you answered yes to any of these questions, then zero-based budgeting just might be the thing for you!

Budgeting is an amazing tool that allows you and your family to reach financial goals, have financial peace, and work towards financial freedom.

My family has been using a zero-based budget for the last four years. We immediately saw the benefits of using it and how it could help us.

Now, I can’t imagine trying to run our household finances without it!

What Is A Zero-Based Budget?

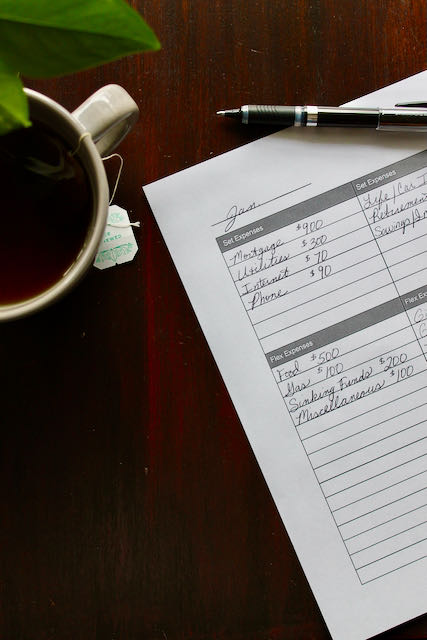

A zero-based budget is when you assign every dollar a place to go before spending your money. So, if you take home $4000 a month, then your expenses should also be $4000 for the month.

That does NOT mean that you spend all $4000 dollars. You just determine where all $4000 will go in advance. It might look something like this:

| Income | $4000 |

| Mortgage | $900 |

| Life/Car Insurance | $120 |

| Retirement | $600 |

| Savings/Investing | $620 |

| Utilities | $300 |

| Internet | $70 |

| Phone | $90 |

| Giving | $200 |

| Food | $500 |

| Gas | $100 |

| Medical | $50 |

| Sinking Funds | $200 |

| Gifts | $50 |

| Miscellaneous | $100 |

| Entertainment | $100 |

| Total | $4000 |

How To Create A Zero-Based Budget

- Write down all income you expect for the month and get a total.

- Create a list of your expenses. I find that it is easier to create a list of set expenses and flexible expenses. A set expense is anything that doesn’t change each month like a mortgage or car payment. Flexible expenses include any category that can be adjusted like entertainment, clothing, or food.

- Next to each category in set expenses write down the amount needed for the month. Get a total and subtract that from your total income for the month. Whatever is left needs to be assigned a place in flexible expenses. The key is assigning every dollar a place to go.

- Add up your set and flexible expenses, subtract that number from your total income for the month. It should equal zero.

Set Expenses+Flexible Expenses – Total Income = 0

It is important to remember to create a new budget every month. Your income may or may not change from month to month, but I can guarantee that your expenses will. That is why it is so important to create a new budget every month to meet your needs for that month only.

Benefits Of Using A Zero-Based Budget

- It allows you to spend money without worry or guilt.

- A zero-based budget helps you meet financial goals much faster than working without a plan.

- It puts an end to frivolous spending.

- You no longer wonder where all of your money went.

Helpful Tips

- Be patient! It will take a few months to create a budget that works for you. Although each budget you create will be a little different, it still takes a few months to get the basics down. When I started, I frequently was surprised with expenses that I should have planned for, but simply forgot about. That got much better with practice.

- Always have a miscellaneous category. This is for basic expenses that were not planned for. No matter how well you plan for expenses, there always seems to be something that is unexpectedly needed. This is for all of the small, unexpected expenses.

- Create a plan for success. When I first started using a zero-based budget I was very motivated to get out of debt. As a result, I would budget a large portion of our income for debt. The problem was that I didn’t budget enough for our living expenses. This made it difficult to stick to our budget.

- Track your spending often. Any time money comes out of your account, you need to track which category it came from in your budget. You can do this using a budgeting app, or my favorite is a pen and paper. It only takes a minute to do. However, if you don’t track your spending regularly it can be a little time consuming to get back on track.

- Don’t quit! Over the years, there have been times when I got a little lazy, or went over budget. When that happens it can be frustrating because you don’t see as much progress towards your financial goals. Getting back on track is much more beneficial to your finances than going back to spending without a plan.

Know Your Purpose

A zero-based budget is a great tool for working towards and achieving financial goals. Whether you want to pay off debt, save for retiremnet, or just increase your savings, having a goal that you are working towards will help you stay motivated and stay on track.

Leave a Reply