If you are like me, you may have had some unplanned expenses that have thrown off your budget. If so, you might want to try using sinking funds. They have really helped us improve our budgeting skills and have been a game changer for us. They might be for you too!

A few years years ago I started budgeting. One problem that I always seemed to have was that I frequently had big expenses that I didn’t plan for because they weren’t something I paid every month.

It’s not like I didn’t know I had to pay my Prime subscription or my son’s baseball expenses every year. I would just simply forget to include them in my budget because they weren’t recurring expenses.

I knew I had to find a way to solve this problem in order to stop all of those frequent unplanned expenses.

That’s when I discovered sinking funds! This completely changed my budgeting game!

If you have never used sinking funds, I hope this will inspire you to clean up your budget and incorporate sinking funds into your life.

What Are They?

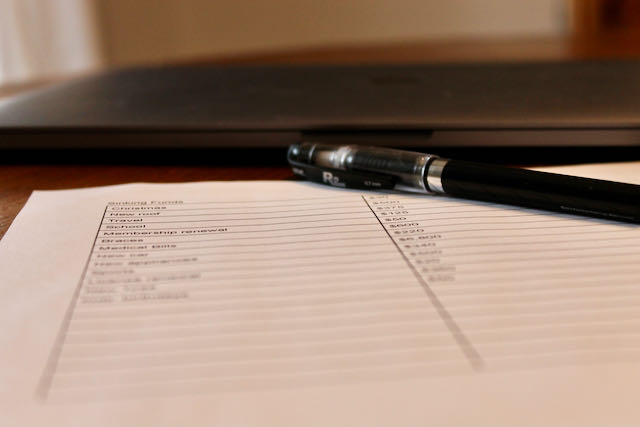

A sinking fund is an account where money is set aside each month for future expenses. Rather than having a large expense, you break it down into smaller amounts and save a little at a time.

Types Of Sinking Funds

- Christmas

- New roof

- Travel

- School (school supplies, clothes, etc. for the beginning of the school year)

- Membership Renewals

- Braces

- Medical Bills

- New car

- New appliances

- Home remodel

- Sports (registration fees, equipment, money for travel)

- License Renewal

- Medical Bills

- Surgery

- New Tires

- Glasses

- Clothing

- Gifts

- Kids’ birthdays

- Pet Care

- Holiday meals

There are no set rules on what types of sinking funds you should have. The list will be different for each family or individual based on your needs. You can choose to save for only larger expenses like Christmas, a new car, or a new appliance.

You can also choose to save for lots of smaller expenses that aren’t part of your regular monthly expenses.

Personally, I choose to have a sinking fund for any expense that will be over $100. This isn’t an amount that will break the budget, but I found that it is what works best for our family.

How To Create a Sinking Fund

- Create a list of annual expenses that you only have once a year. This might include subscription memberships, Christmas, sports/activities for kids, etc.

- Add to your list any additional expenses that aren’t regular annual expenses. These are expenses that you anticipate within the next year or so. This would include things like braces for your child, a new appliance that you may need soon, an upcoming surgery, etc.

- Determine how much money you need to save for each item.

- For each item on your list, figure out how many months you have to save before you expect to pay for that particular item.

- For each item, divide the amount needed by the number of months to determine how much you need to save each month for each particular item.

Where Should You Keep Your Sinking Funds?

There are a few ways to save your sinking funds and keep track of them.

Cash Envelopes

An easy way to keep track of your sinking funds is to use cash envelopes. All you need is a single envelope for each category, label it, and put your cash in each month.

Pros

Aside from getting your cash out each month, this is a very low maintance way to save.

Cons

Depending on how many sinking funds you have, you may have a large amount of cash on hand. This could become a problem if you aren’t extremely disciplined because you may use some of that cash for other things.

Separate Account

Another way to save is by keeping your sinking funds in an account separate from your checking account and from your emergency fund.

Many banks offer you the opportunity to open multiple accounts.

You will need to keep track of how much is in each category. I have a simple Google docs page that lists my sinking funds and how much is in each one. Every time I put money in the account, I have to keep track of how much I put in and in what category. The same goes for when I withdraw money from that account. I have to subtract that amount from the category it came from.

Pros

You can quickly glance at your records and see how much you have in each sinking fund.

Cons

You have to be disciplined and keep track each time you put money in or take money out of your account, which is a little more time consuming.

Tips

- Don’t use your sinking funds as an emergency fund. In order for sinking funds to work, you have to have your emergency fund in place first. Even with sinking funds, there will be unexpected expenses. However, by using them, you create a financial plan that makes it less likely that you will need to tap into that emergency fund.

- Don’t borrow money from your sinking funds. Once you start borrowing money from your sinking funds, they tend to lose their value for you. Eventually, your sinking funds will be where you run every time you want extra cash for unnecessary items. By ONLY using your sinking funds for what they are designated for, you are prepared for future expenses and you will see a big difference in your finances.

- You don’t need to put money into every sinking fund every month. For larger expenses like Christmas, I save a little every month throughout the year. However, if one of my kids is having a birthday, I might only need to save for a few months before their birthday because it is not a huge expense.

- See how we budget HERE.

Leave a Reply